Connect With Us

Why SMEs Need Financing

SME stands for Small and Medium Enterprises and it is a very commonly used term. Lately the scope of the term was broadened to include further smaller businesses and it was termed as MSME (Micro, Small and Medium Enterprises). MSME/SME is a segment of business that falls below certain thresholds in terms of revenues, assets or number of employees. These thresholds can vary from country to country but are not much different.

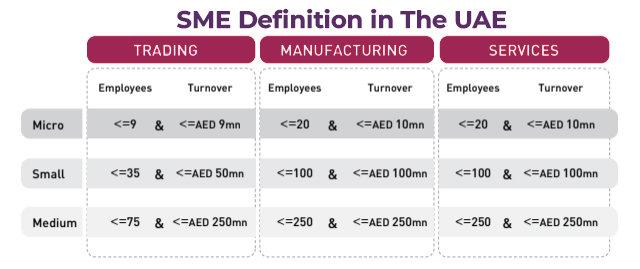

For example, if we look at the UAE, SMEs are not classified at a uniform criterion but have different criteria for different business segments. In UAE, MSMEs are divided into three main categories which are:

- Trading

- Manufacturing

- Services

The threshold for these categories is based on two parameters, turnover and employees’ headcount.

In the following figure, the criteria are explained.

If we look at Pakistan, there are two definitions of SMEs

According to ‘National SME Policy 2007’, SME is defined as the

• ‘Enterprise with an Employment Size up to 250, Capital of Rs.25 million and Annual Sales up

to Rs.250 million.’

As defined by the State Bank of Pakistan;

• A Small Enterprise (SE) is a business entity that does not employ more than 50 persons and

annual sales turnover is up to Rs.150 million.

• A Medium Enterprise (ME) is a business entity that employs more than 50 employees and

less than 100 employees in the case of trading establishments. In the case of manufacturing & service

establishments, employ more than 50 employees and less than 250 employees. For all MEs

annual sales turnover is over Rs.150 million and up to Rs. 800 million.

Contribution of SMEs to the Economy

SMEs contribute a large share of GDP, employ the largest number of people, and has a significant share in revenues.

Again we will evaluate this with the stats from the two countries;

In UAE SME represents 95% of all business establishments, accounts for 42% of the workforce and contributes around 40% to the total value addition to the UAE’s economy.

In Pakistan, SMEs are the largest contributor to employment generation in 78% of non-agriculture sector employment and have 25% of the share in exports of the country and 40% to the value addition in the economy.

Why SMEs Need Financing

SMEs need financing for a variety of reasons ranging from support to their growth, operations, and sustainability. Following are the key reasons why SMEs need financing:

For Cash Flow Management

It is very crucial for an SME to maintain a healthy cash flow. Financing can help bridge cash flow gaps to ensure the smooth cash flow required for smoother operations.

For Working Capital Needs

Funds are required by SMEs to manage their day-to-day operational expenses like salaries, rent, utility bills, and inventory purchases. A proper supply of funds is critical for ongoing business activities of an SME.

For Business Expansion

Financing is vital for the expansion of business operations. These expansions can be opening new locations, entering new markets, or product/service offerings diversification.

For Proper Inventory Management

It is vital for a business to maintain a sufficient level of inventory to meet customer demand. With the help of financing, SMEs can purchase and manage inventory more effectively.

For Equipment and Machinery Purchases

Investing in machinery, equipment, and technology to increase production, improve efficiency, and reduce cost is very vital for an SME. With financing, businesses can opt for these opportunities.

For Research and Development

By investing in research and development (R&D) SMEs can innovate, create new products or services, and stay competitive.

For Marketing Activities

Marketing and advertising play an important role in increasing sales and improving revenues. Marketing is also very crucial for building brands. Financing can help SMEs do effective marketing.

For Human Resource Development

SMEs need funds to recruit skilled employees and to provide training for existing employees. With financing, SMEs can develop better human capital for growth.

In essence, financing is very vital for a business regardless of its nature and size. For SMEs, it becomes a matter of existence as most of the SMEs die out due to insufficient funding.

Considering these facts, SMEs need access to formal financing. This financial inclusion is necessary for the development of any economy.

Financing Challenges of SMEs

SMEs have greater financing challenges to survive than those of large businesses. These challenges often lead to closure of the businesses. Unlike large enterprises, SMEs have low and sometimes no access to formal financing. This is due to many reasons but the most important of these all is lack of proper collateral.

Most of the formal financing options require collateral usually in the shape of a tangible asset. Larger enterprises have a lot at their disposal in the shape of land, buildings, plants, machinery, and inventories. This is why it is easier for them to get financing against these collateral. When it comes to SMEs, they are unable to fulfill these requirements. This is why SMEs are not given access to financing according to their economic contribution or potential.

Invoice Financing and SMEs

Invoice financing is a type of financing where receivable invoices act as collateral. The business gets its receivables financed on the basis of invoices in hand. Theoretically, it is an ideal type of financing for SMEs having no formal collateral but unfortunately, it is not the same in the practical world.

As an invoice is an internal document between a buyer and a seller, it is subject to multiple types of fraud and misrepresentation. Invoice verification conventionally requires costly and tedious due diligence, considering the short-term nature of invoice financing, it becomes financially inviable for financing institutions

This is where InvoiceMate comes into the picture.

InvoiceMate & Invoice Financing

InvoiceMate is the world’s first blockchain and AI-powered invoice financing enabler. It records all the vital invoicing data to an immutable blockchain. With powerful AI algorithms, it detects and prevents illegitimate invoices from getting into the system. This way the integrity of invoices is ensured in almost real-time. InvoiceMate’s KYI replaces conventional due diligence with an efficient and cost-effective compliance service. Banks and financing institutions can verify the invoices presented to them for financing. With InvoiceMate, SMEs can get access to invoice financing like never before.

Besides invoice financing, InvoiceMate offers multiple working capital financing products for SMEs.

Learn more about InvoiceMate offerings for SMEs by filling out the Contact Form.