Connect With Us

What is Invoice Financing

Invoice Financing is a kind of short-term financing that a business can get against its receivable invoices (Accounts Receivable). The basic purpose of invoice financing is to improve the business’ cash flows by being able to utilize the amount at present which is yet to be received in the future.

Before moving to our main topic, here is an overview of the country’s economy in general and the financial sector in particular.

The Economy of Pakistan

Pakistan is a sizeable regional economy that has an important regional as well as global positioning. According to 2021 statistics, it stands at 44th ranking in Nominal GDP while 24th in PPP GDP. Pakistan has a mixed economy with significant agricultural and industrial attributes. Pakistan has strong trade ties across the globe. Its global export ranking for the year 2021 was 67th. For the same year, Pakistan stood as the 50th largest importer in the world.

An SME Looking for Invoice financing in Pakistan?

Financial Sector of Pakistan

The country has an established financial sector with both local and foreign institutions operating. It comprises a Central Bank (State Bank of Pakistan (SBP)) that regulates Banks, Development Finance Institutions (DFIs), Exchange Companies, and Microfinance Banks (MFBs), whereas the Securities and Exchange Commission of Pakistan (SECP) regulates Non-banking Finance Companies (NBFCs)NBFCs, Insurance Companies, and Modaraba Companies.

As per current data from the State Bank of Pakistan, 34 Banks are operating in Pakistan with more than 16,000 branches in total. These banks include 4 Foreign banks. Besides that, there are 9 DFIs, 11 MFBs, and 52 Exchange companies also operating in Pakistan. Pakistan has also seen a noticeable growth in branchless banking lately.

The stats show there is a large and well-established network of financial institutions across the country. Pakistan has a strong regulatory mechanism in place.

Financing In Pakistan

Contrary to the above statistics about the financial sector, financing (lending) isn’t a developed sector in Pakistan. Compared with peer economies of the same size and nature, Pakistan’s financing sector is not as developed as the other financial institutions. This looks odd that an otherwise functional economy of this size lags in this particular area. Financial experts sight it as a hindrance to economic growth.

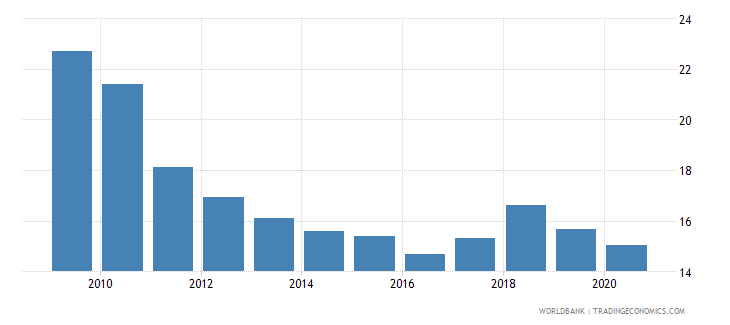

According to a World Bank report, in the year 2020, the domestic credit to the private sector in Pakistan was reported at 15.04 % of GDP. It is significantly low than the regional and emerging economies.

Invoice Financing In Pakistan – Historically

The overall financing market in Pakistan has been relatively small comparing with the size of the economy, the invoice financing market is even more insignificant. A small percentage of businesses, largely exporters would utilize invoice financing facilities. Most of the SME sector in Pakistan is deprived of financing in general and invoice financing in particular.

One of the major reasons for the underdeveloped credit market is the higher ratio of the undocumented or under-documented business sector especially small to medium businesses. Banks and other financial institutions are reluctant to extend credit facilities to SMEs due to insufficient assurance of recovery. Banks cannot trust the business with unverified or in some cases, absolutely no documentation at all.

Unlike large businesses, small businesses don’t possess significantly valuable tangible assets like buildings, plants, and machinery to offer a guarantee to financial institutions.

Another reason for the under-performing credit market can be sought as heavy public sector borrowing in Pakistan. Banks are always comfortable extending credit facilities to the public sector for being more securer than the private sector. Banks and other financial institutions find it easy to facilitate the public sector due to the assurances by regulatory bodies.

Like other Muslim countries, in Pakistan too, many people are reluctant to obtain financing facilities due to the involvement of interest that is forbidden according to Islamic shariah. That is why many people seek shariah-compliant financing solutions only.

Due to these reasons the private business sector in general and SMEs, in particular, are deprived of financing. This way the business cannot contribute to the economy with their actual potential.

In Pakistan, the SME sector contributes 40% of the GDP and 25% of overall exports. Besides this, the SME sector employs a larger population (78% of non-agriculture labor). If the SME sector gets more financing, its contribution to the economy can exponentially increase.

Traditionally, in Pakistan, small and medium businesses have shied away from financing due to higher interest rates and a lack of proper documentation. Invoice financing has mostly remained an alien concept here.

Invoice Financing In Pakistan – Today

Like any other economy of the world, businesses in Pakistan have also suffered from a cash crunch due to COVID 19. In many economies, businesses survived with financing, but in Pakistan, a large segment of businesses especially SMEs was unable to get formal financing for obvious reasons like lack of transparency and payback guarantees. With the recent reforms in Pakistan’s financial sector mainly owing to IMF and FATF regulations, more businesses are required to maintain documentation. With the Federal Board of Revenue ( The central taxation authority) getting more vigilant, the compulsion for documentation is broadening to the businesses which were undocumented or underdocumented previously. Digital payments have also brought more traceability and accountability to the system. All these factors have made financing for SMEs more viable than before but still not up to the mark. As of now the invoice financing segment in Pakistan is still untapped largely.

Invoice Financing In Pakistan – Tomorrow

In recent years fintech has emerged as an exponentially growing industry. Digitalization of payments and other business and financial documentation is making businesses more efficient and reliable. The first and the foremost hindrance in obtaining a financing facility has always been the absence of surety and trust. With the evolution of technologies like blockchain, businesses, as well as regulators, can adopt more trustable and transparent procedures. With an assurance of genuineness and transparency of the presented documents, the lending institution will be much more comfortable in extending the credit facility to an SME or even an individual informal business. This will help SMEs to access financing facilities as needed by the business. The cash flow problem faced by small businesses can be marginalized with invoice financing. This way small businesses can become more productive and can provide more employment.

The invoice financing market in Pakistan is not well-established at present but considering the size and dynamics of the economy, it has great potential. This potential can be tapped with solutions tailored according to the particular requirements of the market.

InvoiceMate and Invoice Financing

InvoiceMate by MateSol is the world’s first complete invoice management system on blockchain. The whole invoice journey from procuring to payment is transparently recorded on the blockchain. This record is immutable and always verifiable by all the relevant parties. The banks and other financial institutions can easily verify the authenticity of the invoices and relevant records to extend the invoice financing facility to the business. This way the business can overcome the liquid cash challenges and can grow according to its fullest potential. InvoiceMate facilitates Invoice financing based on Islamic principles.

More information about InvoiceMate can be found here.

To get the product demo please feel free to write at