Connect With Us

Small and medium-sized businesses (SMEs), which make up 95% of all enterprises in the Emirate, are the backbone of Dubai’s economy. These SME companies employ 42% of the labor force and provide about 40% of the value added produced by Dubai’s economy. The government places a great deal of emphasis on improving the performance and contribution of the SME sector so that these companies are on par with those in other developed, high-income countries. Against this backdrop, the initiatives aimed at the development of SMEs and enhancing support for them have to be formulated on detailed research on their current state and development needs.

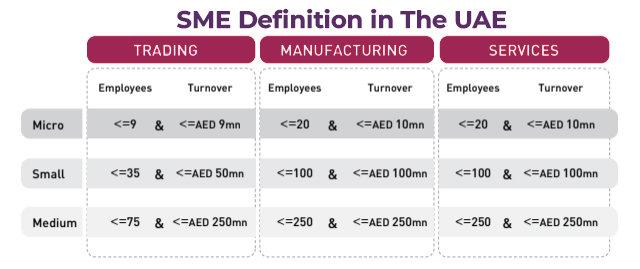

SME Definition in the UAE

An SME in Dubai is defined as any enterprise which meets the thresholds of Employee Headcount and Turnover, as applicable to the sector it belongs to (Trading / Manufacturing / Services). Further, the classification of enterprise size (Micro, Small, and Medium), is based on unique thresholds for each sector. For the purpose of the SME definition, an enterprise is defined as ‘an entity engaged in economic activity, with a legal form i.e. registered as a business either with a Commercial Registry (e.g. DED) or with a free zone / industrial zone authority. As the SME definition is a combination of the employee headcount and turnover, it is compulsory for a business to qualify on both parameters for qualification. The SME definition is a 3 x 3 matrix, with thresholds for a cross-section of each enterprise size (Micro, Small, Medium) and industry (Manufacturing, Services, Trading). In addition, the definition also incorporates certain guidelines for testing the ‘independence’ and ‘autonomy’ of business enterprises (this is explained within the subsequent section on independence criteria).

As per the SME definition, Micro, Small and Medium enterprises within the three sectors are defined as follows:

Trading:

- A micro business is any enterprise with less than or equal to 9 employees and a turnover of less than or equal to AED 9 million.

- A small business is any enterprise with less than or equal to 35 employees and a turnover of less than or equal to AED 50 million.

- A medium business is any enterprise with less than or equal to 75 employees and a turnover of less than or equal to AED 250 million.

- Any enterprise with greater than 75 employees or turnover greater than AED 250 million will be considered large.

Manufacturing:

- A micro business is any enterprise with less than or equal to 20 employees and a turnover of less than or equal to AED 10 million.

- A small business is any enterprise with less than or equal to 100 employees and a turnover of less than or equal to AED 100 million.

- A medium business is any enterprise with less than or equal to 250 employees and a turnover of less than or equal to AED 250 million.

- Any enterprise with greater than 250 employees or turnover greater than AED 250 million will be considered large.

Services:

- A micro business is any enterprise with less than or equal to 20 employees and a turnover of less than or equal to AED 3 million.

- A small business is any enterprise with less than or equal to 100 employees and a turnover of less than or equal to AED 25 million.

- A medium business is any enterprise with less than or equal to 250 employees and a turnover of less than or equal to AED 150 million.

- Any enterprise with greater than 250 employees or turnover greater than AED 150 million will be considered large.

SME Landscape in DUBAI

In terms of number of establishments, SMEs account for 95% of the establishments in Dubai. Micro firms account for 72% of the overall business count in Dubai, followed by Small and Medium firms accounting for 18% and 5% of the business count, respectively. In terms of a sector-wise split of the number of establishments, the Trading sector accounts for a majority (57%) of SMEs in Dubai, followed by the Services sector (35%), and subsequently followed by the Manufacturing sector (8%).

Commercial licenses account for the majority of licenses issued in Dubai (75%), followed by Professional licenses (23%).

Opportunities for SMEs

Thanks to the business-friendly environment and policies of the government, the United Arab Emirates (UAE) is one of the fastest growing regions in the world in terms of business opportunities. Small and Medium-sized Enterprises (SMEs) have lots of opportunities across different sectors. The UAE government has taken several initiatives to support SMEs. These initiatives include financial assistance programs, reduced fees for business setup, and measures to facilitate SME participation in government contracts.

The following two initiatives for SME sector by the UAE government are highly commendable.

With extended government support, business friendly environment and modern infrastructure UAE is suitable for all types of business initiatives. Following categories of businesses in the SME segment are very popular in the UAE.

- Tech Startups

- Tourism, Hospitality and recreation

- Fintech St

- Financial Services

- Real Estate and Construction

- Logistics and Transportation

- Food Processing

- Foood Commodities

- E-commerce

- Renewable Energy

- Healthcare, Wellness & Fitness

- Food and Beverages

- Education and Training

Challenges for SMEs in the UAE

While there are business-friendly policies and initiatives by the UAE government, there are certain challenges for SMEs in the region. Few of the notable challenges faced by businesses in the UAE are as follows;

- Higher Cost of Doing Business

- Higher infrastructure Costs

- Higher Rental/Ownership cost of property

- Rising Cost of Living

- Regulatory Problems

- Access to Financing

- Growing Competition

- Insufficient Human Resources

- Market Saturation

If we look at the overall situation, the UAE is one of the best markets in the world for SMEs despite challenges. Considering the global economic situation, the UAE is a great place to start or run a new small to medium venture. The UAE government is working hard to make it more viable day by day.

Access to Financing

One of the major challenges faced by the SMEs in the region is the lack of access to formal financing. Despite government initiatives, collateral requirements, high interest rates, and a lack of credit history are the challenges faced by SMEs in the UAE while accessing financing. SME lending is still around 9% of the overall business financing which is not in proportion to the actual SME contribution to the economy.

Working Capital Financing Solutions by InvoiceMate

Most of the SMEs face working capital shortages which hampers their growth. Considering the short-term nature of working capital financing, it is mostly ignored by financing institutions. Due to the shortage of cash, many of the SMEs die out in their early stage.

Realizing the importance of working capital financing for businesses, especially SMEs, InvoiceMate has come up with an innovative lineup of tailored solutions for working capital financing.

InvoiceMate is the world’s first blockchain-powered invoice financing enabler. InvoiceMate is DIFC incorporated with a special focus on the SMEs of the region. Empowering SMEs of the UAE through financial inclusion is a core objective of InvoiceMate.

By utilizing the trust, transparency, and efficiency of blockchain and AI, InvoiceMate offers a unique KYI (Know Your Invoice) service that replaces traditional due diligence practices for invoice financing. InvoiceMate offers embedded financing solutions for banks and other financing institutions. With InvoiceMate, SMEs can approach financing services with confidence.

Learn more about InvoiceMate offerings for SMEs by filling out the Contact Form.