Connect With Us

Know Your Invoice or KYI may sound unfamiliar to you in the first place but that won’t be the same once you finish this article. Most of us have seldomly heard about the word KYC (Know Your Customer). Many of us would have also heard about KYB (Know Your Business). Both of these are very common terms in the financing business. Before moving forward let’s get an overview of these terms.

KYC / KYB

KYC (Know Your Customer), as the name suggests, it’s all about knowing your customer or client. As with most business concerns, the entity is the customer, so the term KYC or KYB is interchangeably used with the same meanings. Now, what does knowing your customer means?

KYC is a very important element or practice of the financial industry in general and of the financing industry in particular. In the essence, it is the process of knowing all the required details about the customer/entity. In the post-9/11 world, it has become equally important for the financial sector as well as the financing industry. The process is also known as due diligence. Modern KYC is a set of standard practices that includes three components that are as follows;

- Customer identification program (CIP) governed by the USA Patriot Act 2001

- Customer due diligence (CDD)

- Enhanced due diligence (EDD) or ongoing monitoring of a customer’s account

The purpose of KYC/KYB is to ensure that financial institutions know their customers’ identities, investments, and financial profiles. This is to ensure that proceeds of financial crimes cannot make their way into the financial sector and money laundering can be avoided.

For the financing/lending industry KYC/KYB is very crucial to secure its investments in the shape of lending. The lender needs to know the financial health and integrity of the customer before extending the lending facility. The properly maintained KYC/KYB information can be very vital in case of any default or dysfunction by the borrower.

There are three major steps involved in KYC practices.

- To establish a clear customer identity

- To understand the nature of customers’ financial and related activities to ensure the legitimacy of the source of funds

- To assess and evaluate money laundering risks associated with customers

Now that we’re familiar with the KYC concept and the practices adopted for the purpose, let’s move to our main topic KYI, but first, we need a little overview of invoice financing.

Invoice financing

Invoice Financing is a kind of short-term financing that a business can get against its receivable invoices (Accounts Receivable). The basic purpose of invoice financing is to improve the business’ cash flows by being able to utilize the amount at present which is yet to be received in the future.

Mechanism of Invoice Financing

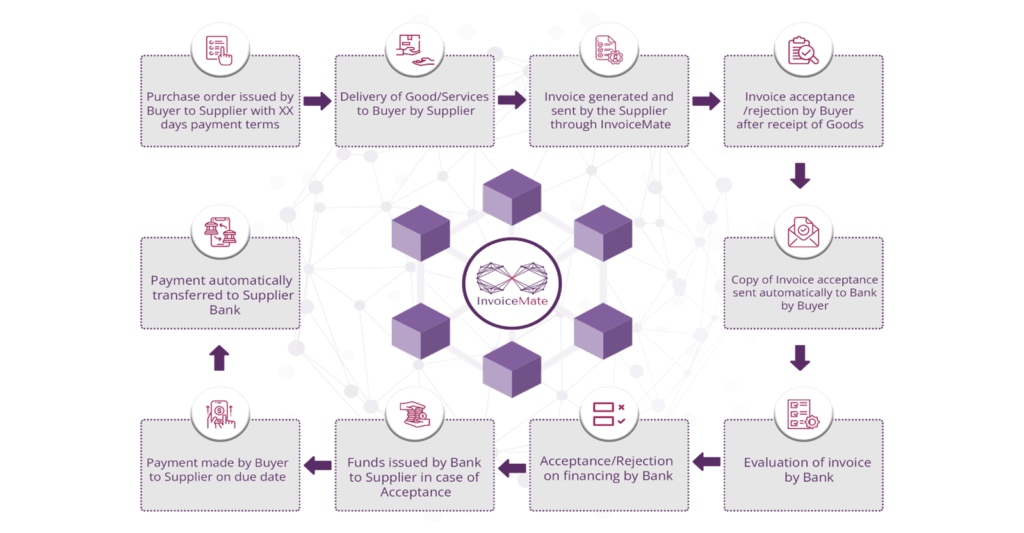

A sells some goods and/or services to B. The payment against the transaction is to be made after 60 days from the date of delivery. A issues an invoice of the same upon B. Now A takes this invoice to the banker/lending institution C and pledges this invoice with them. C extends a significant amount of the receivable invoice to A and keeps the invoice. Once the invoice payment becomes due, B gives the payment to A. A goes to the C and clears their liability along with the service charges of the bank. This way A meets its liquid cash requirement by using its receivable invoice as financial collateral.

From the above elaboration, invoice financing seems to be a very practical and viable form of short-term loan or overdraft for the business as well as for the lender but unfortunately, that’s not the case.

According to the statistics for 2022, the overall global financing market is sized at $7833 billion whereas invoice financing contributes to a mere 0.051% or $4 billion of it. This is a very low number considering that invoices are the most commonly used business document.

What could be the reason for such low numbers of invoice financing? The reason is very simple. The lending institution requires some assurance or security against the amount it lends. Usually, this assurance is provided through some tangible capital asset as collateral by the borrower. These may include but are not limited to land, building, plant & machinery, stocks, or some bonds or certificates. In the case of invoice financing, the invoice is used as financial collateral. Due to certain reasons, lenders don’t consider invoices as bankable collateral. The lenders consider invoices unreliable as they can be:

- Duplicate

- Fake

- Incomplete Information

- Tempered

This is where KYI or “Know Your Invoice” comes into the picture.

Know Your Invoice

KYI or Know Your Invoice is a unique concept introduced by InvoiceMate. InvoiceMate is the world’s first blockchain-powered invoice management system that covers the whole journey of the invoice over the blockchain bringing trust and transparency to the process. From invoice creation to invoice payment and financing each step is recorded in the immutable blockchain ledger. This way the integrity of the invoice and all the associated records is ensured like never before. With KYI, all the concerned parties are always sure of the authenticity and integrity of the invoice. The record of the transaction on the blockchain is always accessible and verifiable.

Know Your Invoice brings a unique value proposition for banks and other lending institutions. With KYI, InvoiceMate eases out the tedious due diligence process for banks. They can independently verify the integrity and authenticity of the invoices presented before them as collateral.

KYI helps MSMEs as well as informal or individual businesses by ensuring the presentable proof of the integrity of their business transactions which is not possible otherwise. This enables them to seek financial assistance that is not traditionally available for businesses of this scale. This financial inclusion helps small businesses to actively contribute toward the development of the economy which paves way for the fulfillment of the United Nation’s sustainable development goals.

Benefits of KYI

KYI is not only helpful for the lenders but it is equally beneficial for the borrowers themselves and all the concerned parties of the business including the parties in the transaction, investors, and independent auditors. Let’s take a look at the categorized benefits of KYI.

For Banks/Financing Institutions

- Efficient compliance & due diligence by gaining deep insights into the entire journey of invoice.

- Fraud resilient, speedier invoice financing cycle reduces operational cost and increases invoice financing clients.

- AI-powered algorithms aiding in risk profiling of invoice financing applicants.

For Invoice Financing Clients

- Next-generation e-invoicing solution for efficient invoice processing, payments, analytics, and real-time reconciliation.

- Invoice processing tool that enables eligibility to get invoice financing for better cash flow.

- Improve credit rating through Blockchain-powered invoice processing resulting in KYI.

KYI is aimed at revolutionizing the invoice financing industry by significantly improving the invoice financing share and making it a viable financing solution for both businesses and banks/financial institutions.

More about InvoiceMate by MateSol, the world’s first blockchain-powered invoice management system can be found here.